On

December 22, 2016, CCM and Tranalysis have offered a free webinar about the

recent price trends of China’s glyphosate market, including a forecast for

2017. Now we are sharing the content with all of those, who were not able to

attend the meeting.

This

webinar is enabled by CCM, the leading market intelligence provider for China’s

agrochemicals market and Tranalysis, the solution for detailed import and export

analysis.

In

November 2016, we faced another month of increasing glyphosate prices in China.

Reasons are mainly the air pollution with the regarding production limitation

and rising prices of raw materials. Furthermore, coal and other energy is experiencing

a price boom, which affects the price of glyphosate again.

Source: Customs Data

and Tranalysis

So,

the Glyphosate technical price keeps rising in China and it is likely to get

back to the era of 4,350 USD/t in the short term, like

it was in the year 2014. I am going to share some insight with you on the recent

price trends in China’s glyphosate market and do a forecast for 2017, to help

you monitor the market trend and make your decisions more sustainable.

The agenda in this webinar is the

following:

-

First, I

give a Review on the glyphosate market in China in 2016

-

Then follows

a Review on some Chinese glyphosate manufacturers

-

The Recent

price trend and analysis of glyphosate in China is being illustrated

-

And at last

I do a Forecast on the glyphosate price in China for 2017

First

of all, let’s have a review on the

glyphosate market in China, 2016.

From

January 2016 to July 2016, the average glyphosate technical price remained low

at about USD2,732/t and hit a historical low record in July this year, with the

price of USD2,519/t.

However,

after the bottom, the glyphosate price kept rising. Till Dec. 2016, the

technical price rose to USD3,491/t, up 38.58% compared to the

price in July.

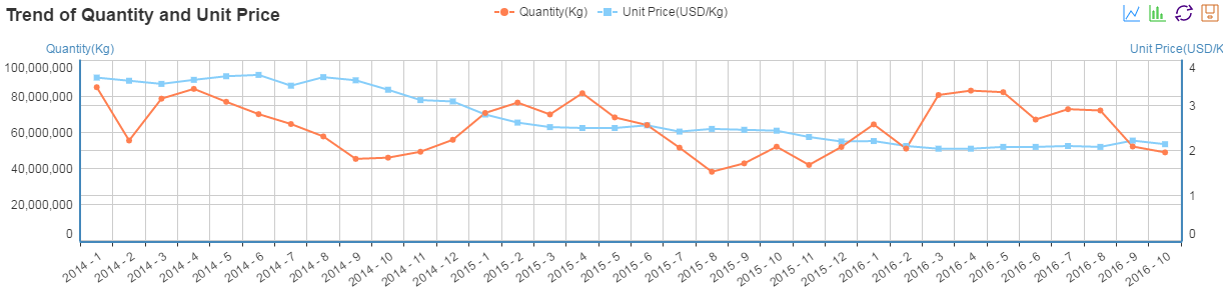

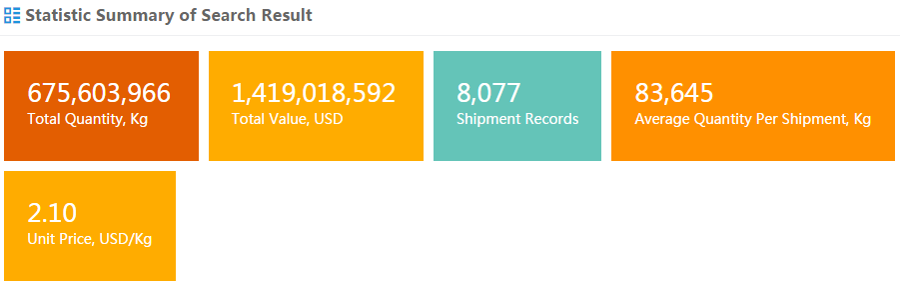

According

to the Chinese Customs data, analyzed and illustrated by Tranalysis, in

Jan.-Oct. 2016, the overall export amount of glyphosate (including technical

and formulations) in China was more than 675 million Kg. The average unit price

was 2.10 USD/Kg, which leads us to the total value of more than 1.4 billion USD

on glyphosate exports.

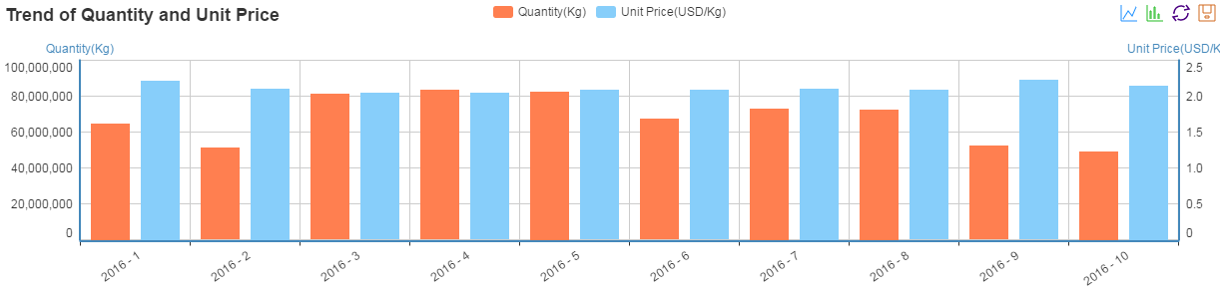

Looking

at the trend of Quantity and Unit price, we can see, that the unit price was

falling in the first half of the year, while it started rising again in the

second half. The Quantity had the peak from March to May and fall down till

October.

Therefor,

the glyphosate market can be divided into two phases in China in 2016: Falling

price trend in the first half year 2016 and a Rising price trend in the second

half.

In the first half 2016:

The

price of USD3,045/t was basically the bottom limit for glyphosate technical. However,

with the average glyphosate technical price remained low at about USD2,732/t, glyphosate

producers suffered terrible declines.

In

the first half 2016, the glyphosate price, which is easy to be influenced by

supply, demand, and inventory, is still hovering over a low level. However,

since prices of raw materials for glyphosate do not fall along with glyphosate,

glyphosate enterprises experienced net profit declines, and even losses.

The

followings are some leading glyphosate enterprises' financial figures related

to the glyphosate business from January to June 2016.

Henan HDF Chemical Co.,

Ltd.

Hunan

HDF's revenue mainly comes from glyphosate Technical, glyphosate formulations

and fine chemicals. Accordingly, revenue from glyphosate takes up about 71% of

the company's total revenue. In the first half 2016, Hunan HDF's net profit

declined by 75.11% YoY. The company explained, that this was mainly affected by

the depressed glyphosate market and low market price. Notably, revenue and

gross profit of Hunan HDF's glyphosate business both declined.

Sichuan Hebang

Biotechnology Co., Ltd.

Currently,

Sichuan Hebang's 50,000 t/a glyphosate project is under trial production, which

did not create profit to the company in the first half 2016. Affected by the

depressed glyphosate market, Sichuan Hebang's PMIDA business also performed

badly:

Revenue:

USD58.12 milllion, down 34.44% YoY

Cost

of sales: USD38.55 million, down 40.94% YoY

Fortunately

for the company is, that Sichuan Hebang's self-produced raw materials helped

reduce some production costs supported the gross profit margin of PMIDA to rise

by 7.29 percentage points to 33.68%. It is disclosed that Sichuan Hebang is one

of the major PMIDA suppliers in China, with a production capacity given at

135,000 t/a.

Nantong Jiangshan

Agrochemical & Chemical Co., Ltd.

In

first half 2016, weak market demand and continuously low price of glyphosate

posed negative impact on Nantong Jiangshan's financial performance. Except for

glyphosate, the gross profit of the company's other products achieved a YoY

rise of 25.67%. Sales volumes and revenue of amide herbicides and fine

chemicals all showed dramatical increases. The major financial figures of

glyphosate are:

Revenue:

USD115.10 million, down 9.71% YoY

Cost

of sales: USD123.20 million, down 3.14% YoY

Gross

profit margin: -9.71%, down 7.27 percentage points YoY

Hubei Xingfa Chemicals

Group Co., Ltd.

Although

Hubei Xingfa's 60,000 t/a glyphosate project has been put into production, it

did not obviously improve the company's financial performance. Regarding the

glyphosate and glycine business, financial figures were:

Revenue:

USD175.63 million, up 34.13% YoY

Cost

of sales: USD152.24 million, up 35.20% YoY

Gross

profit margin: 13.31%, down 0.69 percentage point

Zhejiang Wynca Chemical

Industry Group Co., Ltd.

The

company described their business as “Affected by the fierce market competition

in H1 2016, glyphosate price remained low and dragged down our pesticide

business”. Major financial figures of pesticides are:

Revenue:

USD212.76 million, down 22.57% YoY

Cost

of sales: USD194.85 million, down 22.24% YoY

Gross

profit margin: 8.41%, down 0.40 percentage point YoY

Jiangsu Yangnong

Chemical Co., Ltd.

Jiangsu

Yangnong, as one of the major glyphosate enterprises in China, was inevitably

impacted by the depressed glyphosate market. The Glyphosate price pulled down

financial performance of its herbicide business in H1 2016:

Revenue:

USD81.62 million, down 21.91% YoY

Cost

of sales: USD62.46 million, down 20.48% YoY

Gross

profit margin: 23.48%, down 1.38 percentage points YoY

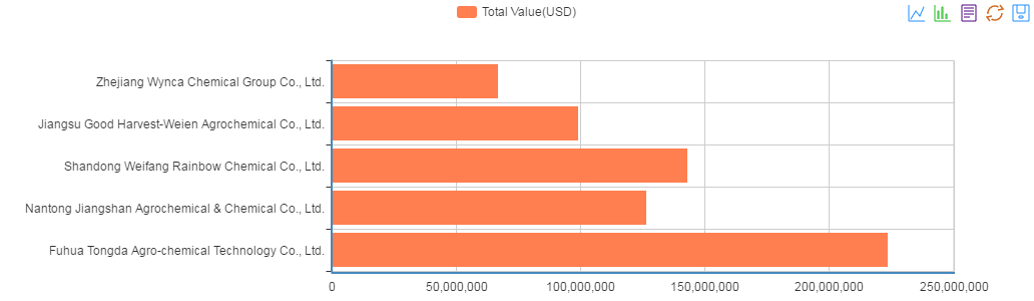

Lets

also have a quick look on the top Chinese Glyphosate players with the data from

China customs, analyzed by Tranalysis. The leading exporter for Glyphosate from

January till October 2016 was Fuhua Tongda Agro-chemical Technology. Their

total export value was more than USD223 million. The second biggest player was Shandong

Weifang Rainbow Chemical. They achieved, an export value of more than USD143

million, while having a higher unit price during the year. The third place is

taken by Nantong Jiangshan Agrochemical & Chemical. Barely having half of Fuhua

Tongda’s value and quantity of export.

In H2 2016:

When

entering H2 2016, the glyphosate price began to rise. The glyphosate technical quotation

has been raised up from USD3,400/t to USD3,750/t in China in Dec. 2016.

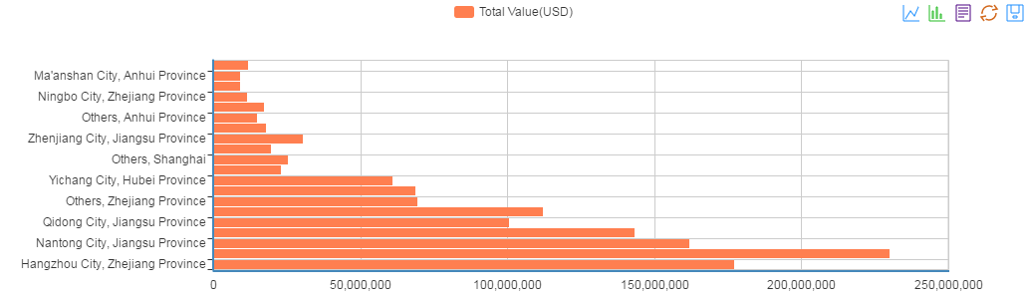

The

most important provinces, according to Tranalysis, are hereby Jiangsu province,

Zhejiang Province, and Hubei Province.

Source: Customs Data

and Tranalysis

The analysis for the

price rise

With

the approaching of peak sale season for glyphosate, all glyphosate enterprises

in both upstream and downstream markets hope to make impressive profits.

In

fact, after experiencing market depression for such a long time, many

enterprises are at loss and are in an urgent need of raising prices to balance

out these losses.

Buyers

usually have their enquiries in Jan. and actual orders in Feb. and March.

Currently, most of the glyphosate enterprises are producing more glyphosate to

prepare for the coming peak season.

Nowadays,

Africa has increasing demand for glyphosate AS; however, the demand for glyphosate

technical still depends on the demand from Europe, the USA and South-east Asia.

A

Staff member from Nantong Jiangshan Agrochemical & Chemical disclosed to

CCM that, the inventory of glyphosate is still high in glyphosate enterprises

now. Although the order has already begun to increase, the demand will only

increase much more after one month.

Rising costs of raw

materials

Rising

costs of raw materials, in some way, support the increasing price for

glyphosate. Currently, the prices of raw materials for glyphosate, namely

glycine, PMIDA etc. showed different degrees of rises.

Glycine price rise

The

ex-works price of glycine increased to USD1,862/t in Dec., up 73.53% compared

to that in Sept. Also the lowest price this year.

The

main two reasons for the soaring price are: Glycine has tight supply due to

production suspension and the heavy winter in northern China

In

Nov. 2016, the Shijiazhuang (Hebei) government decided to take measures on

controlling the environment pollution in all the chemicals industry in

Shijiazhuang, including pesticide productions, concrete industry, pharmacy

industry, steel industry and so on. All

the enterprises and producers in the said industries should suspend their

production from Nov.7 2016 up to Dec. 31 2016.

The

winter in China has two main effects on the glyphosate price at all. First of

all, winter is known to be the storage peak season for glyphosate, while many

manufacturers only have small quantities of inventories. This higher demand in building

a storage is driving prices upwards. Another impact is the heavy snowfall in

northern China. The snow causes difficulties in transportation, which also

leads to a shortage of raw materials and therefore a higher price of upstream

and downstream products.

Regarding

to the raw material route for glyphosate in China, 70% of the production

capacity belongs to glycine capacity. As for Shijiazhuang, the most important

supply and production base for glycine and paraformaldehyde, takes up 50% and

60% of the total raw material supply in China respectively.

Due

to the production limitation at this time, two major glycine suppliers from Hebei:

Shijiazhuang Donghua Jinlong Chemical (with 90,000 t/a glycine capacity) and

Hebei Donghua Yiheng Fine Chemical (also with 90,000 t/a glycine capacity) had

both suspended their productions. It is predicted that the productions of

200,000 t/a glycine capacity will be suspended and limited in the coming weeks.

As

for PMIDA, in Dec., the ex-works price of USD1,840/t, went up 34.2% compared to

that in Jan 2016.

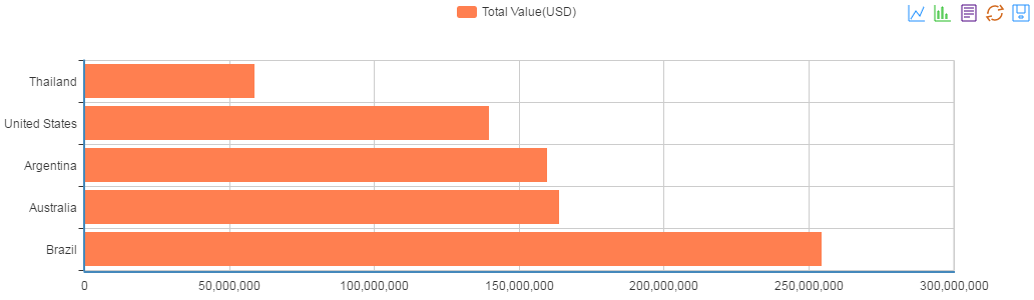

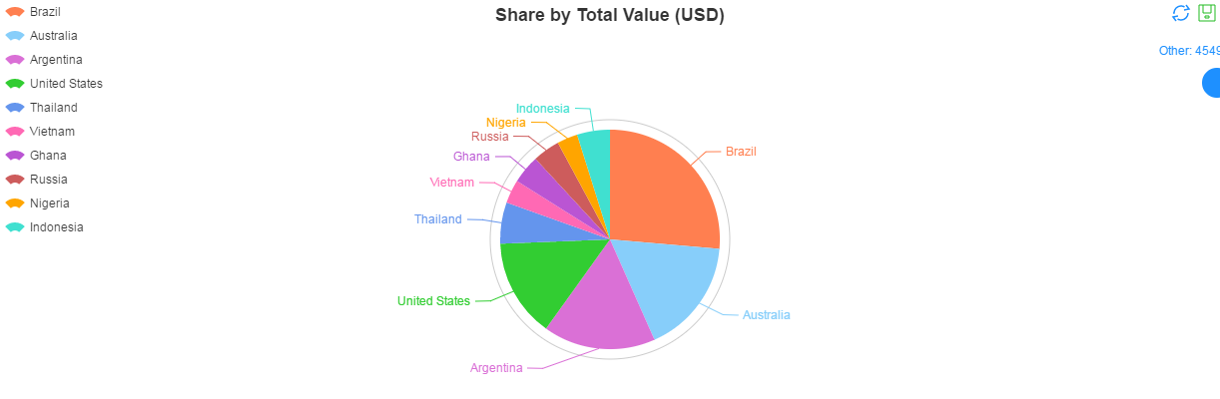

Importing countries and

their share

The

three biggest importing countries of China’s glyphosate from January to October

have been Brazil, Australia, and Argentina. Together, they have about two-third

of the share for the 10 biggest importing countries together. For a deeper

analysis on Glyphosate export, contact our trade exports for a customized

report.

Price support from

environmental pressure

Affected

by the 2016 G20 summit held in Sept., glyphosate enterprises in Zhejiang

Province and the surrounding areas significantly reduced the operating rate,

leading to a fall in the market supply.

On

19 Sept., the 2016 Glyphosate Collaborative Group Work Conference was held in

Beijing, during which the first draft of the Glyphosate Industry Hazardous

Wastes Disposal and Treatment Control Technical Specifications (Outline) was

explained and it revealed how the costs of waste water disposal would further

increase the production cost of glyphosate.

In

addition, the second batch of environmental inspection team will be stationed

in major glyphosate producing provinces including Sichuan and Hubei. When the

time comes, the production of enterprises within these areas may be affected,

and therefore market supply would be largely reduced.

Environmental

pressure from the Chinese government helps increase the production cost of

glyphosate while the suspension on production in most of medium- and

small-scale glyphosate enterprises will hugely affect the supply of glyphosate,

which it is a good chance for the enterprises to rise their quotations.

Forecast with CCM

online platform

According

to the price index calculated on CCM’s Online Platform, the glyphosate price

would keep rising in short term in China, with USD140/t in the price growth.

The

reasons for the increasing, according to CCM, results from the tight glycine

supply due to the production suspension in Hebei.

Under

the high environment pressure from the Chinese government in Hebei, the glycine

producers are facing long-time limitation in their production. Thus, the short

supply is only the beginning.

With

the approaching of the peak season for glyphosate, the demand from the buyers

has already increased. Though some glyphosate enterprises still have some raw

materials that were stored before, the raw material inventory is limited and it

is predicted that it will run out in late Dec.

Reasons of the

glyphosate price in China in 2017

The

Glyphosate technical price is expected to get back to the era of USD4,350/t in

China, according to CCM’s analysts. The rising price will therefore improve the

profits of the Chinese glyphosate enterprises.

During

the peak season for glyphosate, with the intense environmental pressure from

the Chinese government, the supply of raw material will be tighter and the

glyphosate price is expected to increase, which helps to improve the

performance of glyphosate producers, especially those producers with the production

lines of glycine.

Regarding

to the purchasing, as for China’s producers of aqueous solutions, with the exit

of paraquat AS in July this year, they are actively in purchasing the

glyphosate to fill the left market of paraquat AS. Thus, they are quite

acceptable for the rising price of glyphosate.

As

for overseas buyers, though they had a wait-and-see attitude towards the price

rise of glyphosate in the AgroChemEx held in Shanghai in October this year, now

most of the China glyphosate suppliers are all raising the quotations and the

overseas buyers have no choice but to accept the price.

As

for domestic traders, they encourage the glyphosate price to rise actively to

make more profits on the one hand; and to clear out their inventory to speed up

their cash flow when the producers are pushing up the prices on the other hand.

As

for glyphosate producers since August 2016, they finally began to make profits.

To increase the price is the major way to get more profits.

As

CCM gathered all the information inside our pesticide online platform, CCM is

offering a 7-day free trial for you to entirely access the information you

want.

You

could monitor much more than glyphosate price trends by yourselves and receive

all the relative and valuable information in our new CCM Online Platform.

For

the trade data and analysis of Glyphosate and much more Pesticides, ask our

experts at Tranalysis for a consult.